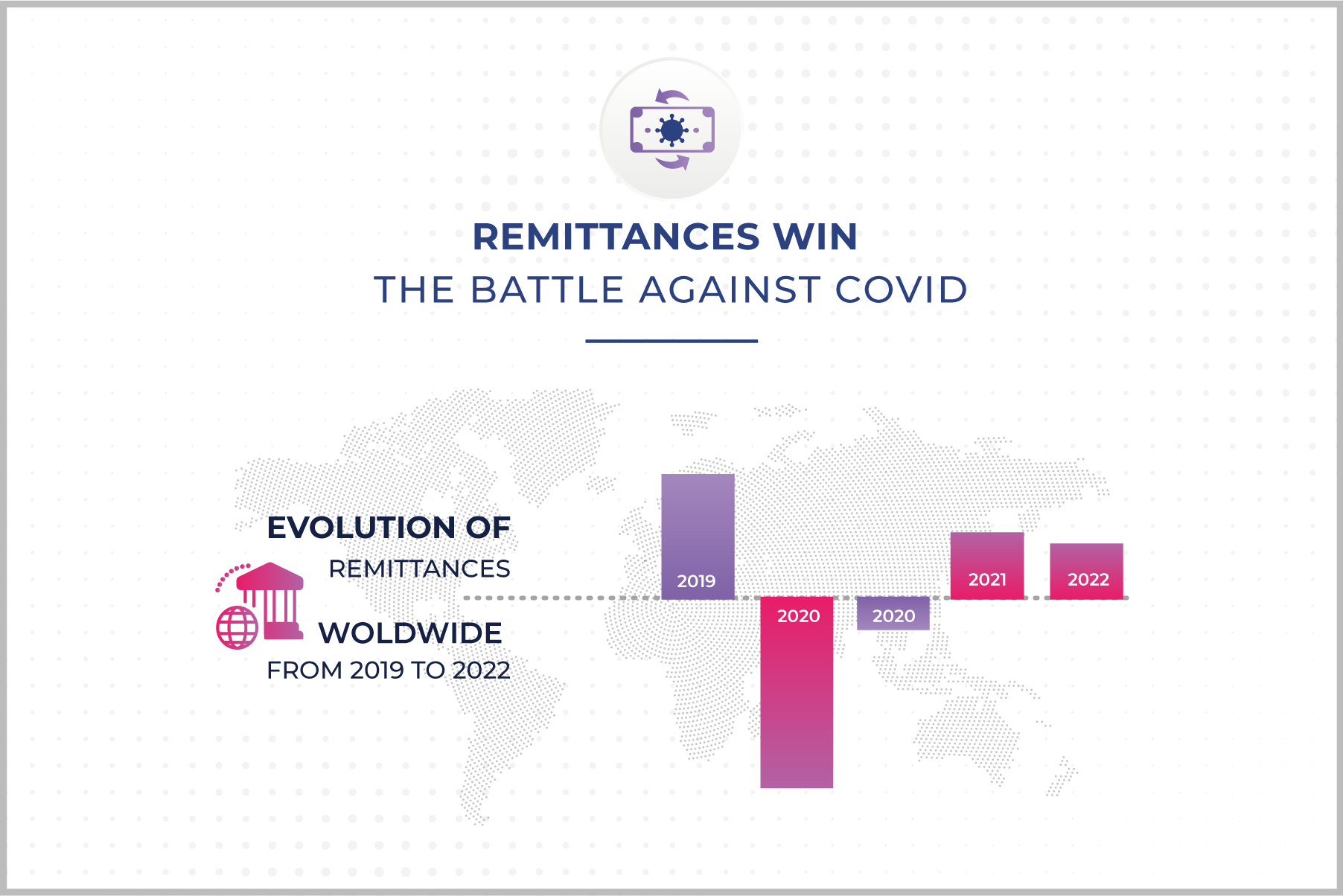

Remittances win the battle against Covid

Far from being undermined by the Covid pandemic, remittances have shown, in the last year, that they are a powerful, solid, and resilient economic tool.

Forecast vs. new reality

The Covid-19 pandemic hit the world just over a year ago. As a result of this crisis, experts predicted a brutal drop in remittance flows of more than 7%. However, against all expectations, this drop did not exceed 1.6%. Latin America and the Caribbean even surprised everybody by registering a growth of 6.5%!

On the other hand, the Sub-Saharan region followed a downward trend, with a significant 12.5% drop in remittance flows. However, this drop was mainly due to the poor results of a single country, Nigeria. If one does not consider the latter, then the figures show that the region has been resilient and has grown at an overall rate of 2.3%. The countries that have led this growth are Zambia (37%), Mozambique (16%), Kenya (9%), and Ghana (5%).

Family and digitization as the main drivers

Family first! If Covid has taught us anything, it is the importance of family and of caring for our loved ones. This is one of the main reasons why remittances have remained strong. Indeed, according to experts, the will to protect, and to continue sending money to family members greatly mitigated the economic decline.

In addition to related effects like fluctuations in oil or currency exchange rates, a very important reason to protect these money transfers is the digitization of payments. Moving remittances from cash to digital has favored the transfer of many transactions from informal to formal channels. Indeed, as Cajnewsafrica points out, the growth in remittances in Kenya, for example, can be largely attributed to financial innovations. The digital transformation in the economic field has allowed mobile phone users to carry out transactions through their devices. This, without a doubt, helped many families receive money from relatives in the diaspora.

Remittances, that key factor in the economy that must be protected

The benefits of remittances for the world’s economy have been widely demonstrated. Still, these transactions come with a lot of associated risks that constantly threaten their safety and stability. These risks include money laundering and “de-risking” activities by foreign banks. The lack of oversight by the involved countries’ relevant authorities aggravates the problem.

X Stream is a remittance compliance and metrics solution that provides governments and authorities with actionable information on each remittance transaction. It uses secure digital technologies to connect banking and financial institutions directly to the source of remittance transaction info.

The remittance ecosystem is imminently moving towards digitization. Should governments thus not make use of the best technology to protect this vital resource?

Want to know more about remittances in Latin America? Click here!